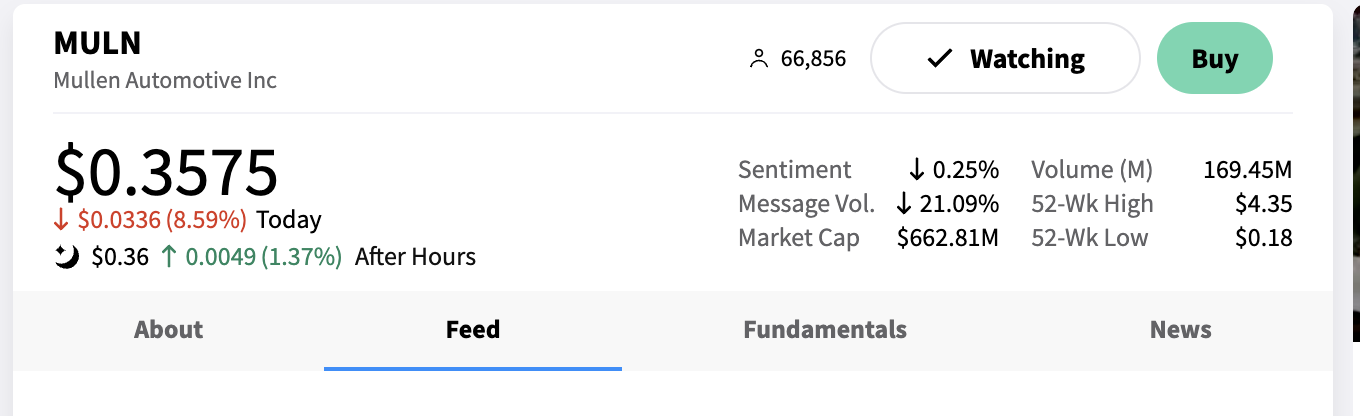

– Mullen Automotive is the newest automotive company on the market..

and the company is set for an exciting 10K release.

This is a company that prides itself on cutting edge technology and innovative designs when it comes to their cars. They are also dedicated to green initiatives, wanting to reduce their carbon footprint as much as possible with each release. With a focus on customer satisfaction and quality craftsmanship, this 10K release will be one to keep an eye on.

When analyzing how a 10-K release could affect investor sentiment, it is important to consider several factors. Firstly, investors will want to be informed about the company’s financial performance and projections for the future. This means that it is important to examine not just the numbers provided in the 10K report but also their broader implications. It is also important to take into account any potential risks associated with the company’s operations, as well as any changes in executive leadership or strategies that could affect the company’s long-term prospects.

Additionally, investors should take note of any changes in regulations or other external factors that could influence the company’s performance. Finally, investors should consider the overall sentiment of the market and whether or not a 10-K release could trigger a change in investor sentiment. By taking all of these factors into account, investors can gain a better understanding of how a 10-K release could potentially impact their portfolios.

Investors and analysts alike are eagerly awaiting the release of a company’s 10K filing. This important report offers a wealth of information about the financial health of the business, including how it is performing compared to the previous fiscal year. This allows investors to make informed decisions on whether they should invest in a company or not. The 10K release is an event highly anticipated by investors as it reveals financial performance data, as well as a number of other relevant facts, such as details of executive compensation and potential risks and opportunities. As such, this information can be used to gauge the potential future success or failure of a company, making investors very keen to know the results before investing their hard-earned money.

StockTwits

its10-organization10-forinvestment. investment. When a company releases their 10K filing, there is potential for the stock to take a hit or make gains depending on how investors interpret the financial health of the organisation. It’s important to understand the key components of financial statements, such as cash flow statements, income statements, and balance sheets, so t As a potential investor, it is important to pay close attention to the 10K results released by a company.

This report provides investors with a comprehensive insight into the financial performance and position of a company, including its assets and liabilities, income and expense details, as well as other important information related to the organization’s operations. By analyzing these results, investors can gain an understanding of the company’s financial situation and make an informed decision about whether to invest in it.

This report provides investors with a comprehensive insight into the financial performance and position of a company, including its assets and liabilities, income and expense details, as well as other important information related to the organization’s operations. By analyzing these results, investors can gain an understanding of the company’s financial situation and make an informed decision about whether to invest in it.

Additionally, understanding these results can help investors identify areas of improvement in order to maximize their return on investment.Investors can interpret them accurately. Market sentiment and analyst opinion can also play a role in determining financial impact. By taking the time to study a company’s financials, investors can better understand the potential for success or failure and determine whether or not to invest.

Additionally, understanding these results can help investors identify areas of improvement in order to maximize their return on investment.Investors can interpret them accurately. Market sentiment and analyst opinion can also play a role in determining financial impact. By taking the time to study a company’s financials, investors can better understand the potential for success or failure and determine whether or not to invest.

When analyzing how a 10K release could affect investor sentiment, it is essential to consider the details of the report. What information is included? Is there any new insight or understanding that can be gained? Will the report have an impact on the stock price? Answering these questions can help determine the effect of the 10K release on investor sentiment. Furthermore, looking at historical trends can provide additional insight into how investors have reacted to similar releases in the past.

It is also important to gauge the sentiment of the broader market and understand how the news relates to what is happening elsewhere in the industry. Finally, one should consider the overall tone of the report and pay attention to any potential red flags that could lead to decreased investor confidence. By weighing all of these factors, analysts can come to a more informed conclusion about how the 10K release may influence investor sentiment.

https://www.sec.gov/Archives/edgar/data/1499961/000155837023000273/0001558370-23-000273-index.htm

Investors should pay close attention to the 10K results, as they provide a comprehensive overview of the financial activities and performance of a company over a 12-month period. They provide a comprehensive and detailed look at a company’s finances, including its assets, liabilities, income, expenses, and cash flows. The 10K also includes information about strategic plans, risks, and other disclosures that are important for investors to be aware of. By reading through the 10-K, investors can gain a better understanding of the company, allowing them to make more informed decisions about their investments.

Take a look for yourself and let us know what you think.

| 1 | 10-K | muln-20220930x10k.htm iXBRL | 10-K | 3637472 |

| 2 | EX-10.2A | muln-20220930xex10d2a.htm | EX-10.2A | 12669 |

| 3 | EX-10.2B | muln-20220930xex10d2b.htm | EX-10.2B | 73224 |

| 4 | EX-10.2C | muln-20220930xex10d2c.htm | EX-10.2C | 37620 |

| 5 | EX-10.22 | muln-20220930xex10d22.htm | EX-10.22 | 29139 |

| 6 | EX-10.23 | muln-20220930xex10d23.htm | EX-10.23 | 51688 |

| 7 | EX-10.23(A) | muln-20220930xex10d23a.htm | EX-10.23(A) | 75530 |

| 8 | EX-10.24 | muln-20220930xex10d24.htm | EX-10.24 | 30384 |

| 9 | EX-10.25 | muln-20220930xex10d25.htm | EX-10.25 | 67035 |

| 10 | EX-10.25(A) | muln-20220930xex10d25a.htm | EX-10.25(A) | 165973 |

| 11 | EX-21.1 | muln-20220930xex21d1.htm | EX-21.1 | 5914 |

| 12 | EX-23.1 | muln-20220930xex23d1.htm | EX-23.1 | 3768 |

| 13 | EX-31.1 | muln-20220930xex31d1.htm | EX-31.1 | 18929 |

| 14 | EX-31.2 | muln-20220930xex31d2.htm | EX-31.2 | 18926 |

| 15 | EX-32.1 | muln-20220930xex32d1.htm | EX-32.1 | 13142 |

| 16 | GRAPHIC | muln-20220930x10k001.jpg | GRAPHIC | 57442 |

| 17 | GRAPHIC | muln-20220930x10k002.jpg | GRAPHIC | 25174 |

| 18 | GRAPHIC | muln-20220930x10k003.jpg | GRAPHIC | 38761 |

| 19 | GRAPHIC | muln-20220930x10k004.jpg | GRAPHIC | 57912 |

| 20 | GRAPHIC | muln-20220930x10k005.jpg | GRAPHIC | 50159 |

| 21 | GRAPHIC | muln-20220930x10k006.jpg | GRAPHIC | 98457 |

| 22 | GRAPHIC | muln-20220930x10k007.jpg | GRAPHIC | 96192 |

| 23 | GRAPHIC | muln-20220930x10k008.jpg | GRAPHIC | 67785 |

| Complete submission text file | 0001558370-23-000273.txt | 16006072 |

| 24 | EX-101.SCH | muln-20220930.xsd | EX-101.SCH | 109499 |

| 25 | EX-101.CAL | muln-20220930_cal.xml | EX-101.CAL | 110756 |

| 26 | EX-101.DEF | muln-20220930_def.xml | EX-101.DEF | 421911 |

| 27 | EX-101.LAB | muln-20220930_lab.xml | EX-101.LAB | 766507 |

| 28 | EX-101.PRE | muln-20220930_pre.xml | EX-101.PRE | 696364 |

| 134 | EXTRACTED XBRL INSTANCE DOCUMENT | muln-20220930x10k_htm.xml | XML | 2448475 |

The content herein is opinion only and does not represent fact, investment advice, or literally any other action. It’s entertainment only and nothing can be considered accurate actionable data. Should you decide to action based on any statements herein, you are strictly advised to speak to a financial planner, lawyer, and securities advisor.

Excerpt from the 10K:

o

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ___

Commission file number: 001-34887

MULLEN AUTOMOTIVE INC.

(Exact name of registrant as specified in its charter)

| Delaware | 86-3289406 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 1405 Pioneer Street Brea, California 92821 |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: (714) 613-1900

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 | MULN | The Nasdaq Stock Market, LLC (Nasdaq Capital Market) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ YES ☒ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ YES ☒ NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ YES ☐ NO

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ YES ☒ NO

The aggregate market value of the registrant’s common equity, other than shares held by persons who may be deemed affiliates of the registrant, as of March 31, 2022 was approximately $656.8 million.

The registrant had 1,696,543,863 shares of common stock outstanding as of January 6, 2023.

Documents Incorporated by Reference: None